NEW POINTS ON COMPULSORY SOCIAL INSURANCE APPLIED FROM 01/09/2021

According to Circular 06/2021/TT-BLDTBXH issued by the Ministry of Labour, Invalids and Social Affairs, from 01/09/2021, there will be new regulations with many major changes, affecting compulsory social insurance participants.

- Adjustment of subjects participating in compulsory social insurance

Clause 1, Article 1 of Circular 06/2021 stated:

Persons who work part-time in communes, wards and townships and concurrently enter into labor contracts specified at Points a and b, Clause 1, Article 2 of the Law on Social Insurance, shall participate in compulsory social insurance according to the provisions of the Law on Social Insurance. the subjects specified at Points a and b, Clause one, Article 2 of the Law on Social Insurance.

Thus, if a person who works part-time in a commune, ward or township but also works under a labor contract with a term of from full 1 month to less than three months, he/she must participate in social insurance in groups. employees working under contracts.

This is a completely new regulation that has not been mentioned before in Circular No.59/2015/TT-BLDTBXH.

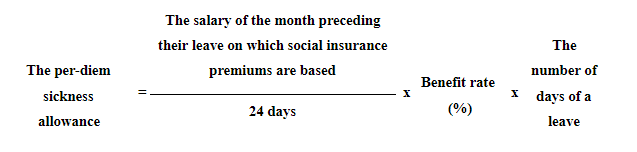

- Sickness benefits when not taking a full month’s leave

According to the provisions at point b, Article 6 of Circular No. 59/2015/TT-BLDTBXH, in case with odd days for incomplete month, the sickness allowance is calculated according to the formula below:

Circular 06/2021 continues to inherit this regulation and adds the maximum amount of the benefit to the regulations at the same time when they calculate it following this formula.

- Changes in salary for calculation of sickness benefits

According to Clause 3, Article 1 of Circular 06, the rate of sickness benefits for employees subject to compulsory social insurance payment who suffers from illness, accidents (not occupational accidents) or has to take time off work to take care of their children under 07 years old for a period of 14 working days or more:

Calculated on the salary of the month preceding their leave on which social insurance premiums are based (previously, it was calculated on the salary of that month on which social insurance premiums are based.).

In case the following months are still sick and have to take leave, the benefit rate is calculated on the salary of the month preceding their leave on which social insurance premiums are based (new addition).

Reference:

日本語

日本語 Vietnamese

Vietnamese